What Documents Should I Gather to Prepare My Income Tax Return?

Updated on January 19, 2025

Below is a list of the most common items you should gather for preparing your 2024 individual income tax return. Each individual's tax situation is different; not all items may apply to you. For a list of documents to gather for other tax years, click here.

-

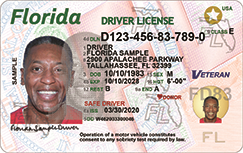

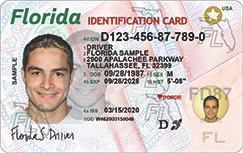

A non-expired government issued photo identification document for yourself AND your spouse (if married filing jointly). RECOMMENDED: state issued driver's license or state issued identification card. The following are acceptable if you do NOT have a state issued license or ID card: U.S. military identification card, U.S. passport, or U.S. resident alien identification card

-

Social Security cards for yourself, spouse and dependents. We also need birth dates for everyone on your tax return. If the person does not have a Social Security number, then we will need an IRS Individual Taxpayer Identification Number (ITIN) for that person which would either appear on an ITIN Card or ITIN Authorization Letter. (Returning clients do NOT need to provide this information for anyone shown on last year’s tax return unless there is a change)

-

Complete copies of your federal and state income tax returns (including all worksheets) for tax years 2021, 2022 and 2023. (Returning clients do NOT need to provide this information)

-

For direct deposit of your tax refund OR direct debit of your tax payment, please provide us with the ACH routing transit number AND account number for your financial institution checking or savings account

Sample Checks Showing Location of Routing Number and Account Number

-

If you, your spouse and/or dependents were a victim of tax identity theft OR you voluntarily requested an IRS Identity Protection PIN (IP PIN), we will need the unique six-digit IP PIN assigned to the person. Each year the IRS issues the person a NEW Notice CP01A with an updated six-digit IP PIN to use on ALL tax returns that are filed within that calendar year. This IP PIN is REQUIRED to file a federal income tax return. Lost or misplaced your IP PIN? Retrieve IP PIN Online. After logging in, go to "Your Profile", then scroll down the page to the "Identity Protection PIN" section to see the six-digit PIN. You can also go to the "Notices and Letters" tab to view the official Notice CP01A "We Assigned you an IP PIN"

-

Copy of divorce decree or separation agreement (if applicable)

-

If a spouse or dependent you are claiming on your tax return is deceased, please provide a copy of the death certificate. The cause of death is not required to be shown

-

Records showing amounts and dates of any "estimated tax" payments you sent to the IRS and/or state tax agencies for tax year 2024. The due dates of these estimated tax payments were April 15, 2024, June 17, 2024, September 16, 2024, and January 15, 2025 (The September 16th and January 15th payment dates were extended until May 1, 2025 for those who were in the federally declared disaster areas for Florida Hurricane Debby and Florida Hurricane Milton). If you are not sure of the dates and amounts of your IRS estimated tax payments, Login to Your IRS Online Tax Account and go to the "Payments" tab, select “Payment Activity” and then scroll down to “Processed Payments”

-

If you, your spouse and/or dependents had health coverage at any time during the year that was obtained through the federal government's Health Insurance Marketplace® (Healthcare.gov) - also known as ObamaCare OR a State Exchange, you MUST obtain Form(s) 1095-A

.

You CANNOT file your income tax return without

this form if any premium tax credit subsidies were allowed!

(NOTE: If you are claiming a person on your tax return, such as

a child, and someone else obtained the health insurance through

the Marketplace® or State Exchange for that person, you will need

to obtain the Form 1095-A from that person in order to prepare your

tax return). If any of your dependents are filing a separate

tax return, you MUST provide a copy of their tax

return since their income MAY be needed for the

sole purpose of calculating your household income. For

information on how to obtain your Form 1095-A,

click here

.

You CANNOT file your income tax return without

this form if any premium tax credit subsidies were allowed!

(NOTE: If you are claiming a person on your tax return, such as

a child, and someone else obtained the health insurance through

the Marketplace® or State Exchange for that person, you will need

to obtain the Form 1095-A from that person in order to prepare your

tax return). If any of your dependents are filing a separate

tax return, you MUST provide a copy of their tax

return since their income MAY be needed for the

sole purpose of calculating your household income. For

information on how to obtain your Form 1095-A,

click here -

If you are claiming a qualifying child who lived with you in the United States for more than half the year (greater than 6 months - at least 184 nights for calendar year 2024) who was under age 19 as of December 31, 2024 OR under age 24 AND a full-time student for at least some part of any five calendar months of year 2024 OR any age and was totally and permanently disabled at any time during the year, we recommend you provide at least ONE of the following documents

-

If you want to claim your child AND you are considered the noncustodial parent for tax purposes (the child spent LESS nights with you during the year than the other parent) and you were never married OR your divorce took place AFTER December 31, 2008, we will need a completed, signed and dated Form 8332

from the custodial parent

from the custodial parent -

If you adopted a child, please contact us for the exact documents that we will need. The required documents are different for domestic and foreign adoptions

-

Last paystub for each job you and your spouse (if married filing jointly) had during the year. The paystub is optional but recommended to see certain items that may be in question such as federal withholding, pre-tax deductions, and post-tax deductions

-

ALL W-2's, 1098's, 1099's, plus a list of any other gross income including nontaxable income for which you did NOT receive a tax document. For Social Security benefits received, we will need a Form SSA-1099

-

Unemployment Compensation (Form 1099-G). For information on how to obtain your Florida Unemployment Form 1099-G, click here

-

Schedule K-1's received from S-corporations, partnerships, estates, and/or trusts. Need a Schedule K-1 from a publicly traded partnership (PTP)? You may be able to access it by clicking here

-

Winnings such as gambling, lottery, prizes, awards, etc. Gambling winnings may be shown on Form W-2G

and

prizes and awards may be shown on

Form 1099-MISC

and

prizes and awards may be shown on

Form 1099-MISC

-

Information on any foreign income, foreign inheritance, foreign financial accounts, foreign trusts, or other foreign assets such as real estate you had at any time during the year

-

Alimony amounts paid/received ONLY if divorce decree or separation agreement is dated BEFORE January 1, 2019. If alimony was PAID, we will need ex-spouse’s Social Security number. If you received and/or paid alimony, we will need the "original" date of the divorce or separation agreement

-

If you are a sole proprietor / self-employed / independent contractor / subcontractor / Form 1099-NEC / Form 1099-MISC

,

we will need to know the gross amount of income and your expenses

separated into different expense categories. If you acquired any

assets that have a useful life of greater than one year, they may

need to be depreciated or amortized. We will need a description of the asset,

date placed in service for business purposes, cost, and business

use percentage. If you accept credit/debit cards and/or receive payments

from a third-party payment network such as Amazon®, eBay®,

PayPal® or Google Checkout®, you may receive a

Form 1099-K

,

we will need to know the gross amount of income and your expenses

separated into different expense categories. If you acquired any

assets that have a useful life of greater than one year, they may

need to be depreciated or amortized. We will need a description of the asset,

date placed in service for business purposes, cost, and business

use percentage. If you accept credit/debit cards and/or receive payments

from a third-party payment network such as Amazon®, eBay®,

PayPal® or Google Checkout®, you may receive a

Form 1099-K

showing amounts paid to you. You may

download a "2024 Business Income and Expense Worksheet" to assist

you in preparing this information

showing amounts paid to you. You may

download a "2024 Business Income and Expense Worksheet" to assist

you in preparing this information -

Rental properties – we will need to know about your rental income and rental expenses separated into different expense categories, depreciation claimed on the property in prior years (if any) and property purchase information which may be shown on a HUD-1 Settlement Statement

,

ALTA Settlement Statement

,

ALTA Settlement Statement

OR

Closing Disclosure

OR

Closing Disclosure

.

You may

download a "Rental Income and Expense Worksheet" to assist you

in preparing this information

.

You may

download a "Rental Income and Expense Worksheet" to assist you

in preparing this information -

If you purchased or refinanced any real estate, please provide us with the HUD-1 Settlement Statement

,

ALTA Settlement Statement

,

ALTA Settlement Statement

OR

Closing Disclosure

OR

Closing Disclosure

-

If you sold any capital assets such as real estate, stocks, or mutual funds, we will need to know about your cost or other basis and date of purchase, inheritance, or gift. For stocks and mutual funds, we will need Form(s) 1099-B. For sale of real estate including land, you may receive Form 1099-S

-

Digital Assets – Cryptocurrency / Virtual Currency / NFTs (Non-Fungible Tokens) – If you sold or exchanged digital assets or used digital assets to pay for goods or services, you are required to report the gain/loss on these transactions. Please provide us with dates of acquisition and dates of sale/use/exchange. We will also need the values of the digital assets at the time of the transactions. The difference in the values will result in a capital gain or capital loss. Digital assets that have been held greater than one year are considered to be a long-term capital gain/loss. Digital assets that are held one year or less are considered to be a short-term capital gain/loss. If you received digital assets as income in the ordinary course of your business, these amounts must be added to your gross business income. Some examples of these digital assets that have value are Bitcoin, Ethereum, Dogecoin, Shiba Inu, Cardano, Ripple, Litecoin and Binance Coin. NFTs are one-of-a-kind non-fungible tokens which have a unique code that cannot be duplicated. They are digital certificates of authenticity or ownership rights built on blockchain. Investors who have gains or losses from the sales or trades of NFTs are subject to the capital gain/loss rules. Creators of NFTs that sell the NFTs on the marketplace are subject to ordinary income tax on the profits. Having problems generating tax reports? Many companies such as Coinbase, Binance, Kracken and Cash App will let you link to a third-party provider to generate tax reports. Here are links to some of those third-party providers: ZenLedger • CoinTracker • CoinLedger

-

If you had any cancellation or forgiveness of debts such as credit cards, auto loans, mortgages, etc., please provide us with Form(s) 1099-C

from the lender. Most

forgiven student loans are tax-free and a Form 1099-C

will NOT be issued

from the lender. Most

forgiven student loans are tax-free and a Form 1099-C

will NOT be issued -

If you had a foreclosure on your property, please provide us with Form 1099-A

from the lender. If you had a short sale on your property and the

lender has forgiven all or part of the debt, please provide us with

Form 1099-C

from the lender. If you had a short sale on your property and the

lender has forgiven all or part of the debt, please provide us with

Form 1099-C

from the lender

from the lender -

IRAs – Individual Retirement Accounts – Records showing CONTRIBUTIONS made to Traditional IRAs, and/or Roth IRAs. This information may be shown on Form 5498

.

If an early premature DISTRIBUTION was made from a Roth IRA, we

need to know about your contributions and distributions for ALL

prior years

.

If an early premature DISTRIBUTION was made from a Roth IRA, we

need to know about your contributions and distributions for ALL

prior years -

HSAs – Health Savings Accounts – Records showing CONTRIBUTIONS made to an HSA which may be shown on Form 5498-SA

.

If you used any funds in your HSA for medical or other purposes,

these are DISTRIBUTIONS and we will need

Form 1099-SA

.

If you used any funds in your HSA for medical or other purposes,

these are DISTRIBUTIONS and we will need

Form 1099-SA

.

If any DISTRIBUTIONS were made from an HSA that were NOT used

for qualified unreimbursed medical expenses, we will need to

know the amount

.

If any DISTRIBUTIONS were made from an HSA that were NOT used

for qualified unreimbursed medical expenses, we will need to

know the amount -

Itemized deductions – Out of pocket medical and dental expenses such as health and dental insurance premiums (do not include pre-tax amounts through your employer), doctors, hospitals, labs, prescriptions, eye exams/glasses, medical/dental co-payments, home improvements done for medical purposes, number of miles driven for medical purposes, real estate taxes, sales tax, state and local income taxes, mortgage interest and points (Form 1098

),

investment interest, charitable contributions, casualty losses (such

as a hurricane losses - see below) in a federally declared disaster area and gambling losses (only up

to the amount of your reportable gambling winnings)

),

investment interest, charitable contributions, casualty losses (such

as a hurricane losses - see below) in a federally declared disaster area and gambling losses (only up

to the amount of your reportable gambling winnings) -

Hurricane / California Wildfire Losses - If you suffered losses from Hurricane(s) Debby, Helene and/or Milton or had losses from the California Wildfires, you may be able to claim losses in these presidentially declared disaster areas even if you don't qualify to itemize deductions (see Federal Disaster Tax Relief Act). Please provide documentation for your losses such as receipts for repairs, estimated repair costs, appraisals showing the value of your property immediately before the hurricane AND also the value of your property immediately after the hurricane, insurance estimates and reimbursements including any tax-free grants or reimbursements such as payments from FEMA

-

For child and dependent care expenses, we will need the amount paid along with the name, complete address, and federal tax employer identification number (EIN) of the provider (Social Security number, if the provider is a person). You may use Form W-10

to obtain the provider's information

to obtain the provider's information -

Amounts paid for post-secondary education, such as college tuition, books, supplies and equipment for you, spouse and/or your dependents. Please provide us with the 2024 Form 1098-T

that is issued to the student by the educational institution. Sometimes

the student may have to login to their educational institution's

online student portal to view and print the Form 1098-T. (NOTE:

If the student was billed for tuition at the end of 2023 and it

was not paid to the institution until early 2024, please provide

us with a copy of the

2023 Form 1098-T

that is issued to the student by the educational institution. Sometimes

the student may have to login to their educational institution's

online student portal to view and print the Form 1098-T. (NOTE:

If the student was billed for tuition at the end of 2023 and it

was not paid to the institution until early 2024, please provide

us with a copy of the

2023 Form 1098-T

for that student). For information on how to access Form 1098-T

online at some educational institutions in Central Florida,

click here. We highly suggest you get a "Financial Transcript"

from the educational institution showing all payments (including

student loan) payments they received for tuition and fees

during year 2024

for that student). For information on how to access Form 1098-T

online at some educational institutions in Central Florida,

click here. We highly suggest you get a "Financial Transcript"

from the educational institution showing all payments (including

student loan) payments they received for tuition and fees

during year 2024 -

Moving expenses for active-duty members of the Armed Forces who move due to a military order because of a permanent change of station

-

Clean Vehicle Tax Credit – You may be entitled to a tax credit up to $7,500 for the purchase of a new electric vehicle and up to $4,000 for the purchase of a used electric vehicle. We will need documentation showing the vehicle year, make, model, vehicle identification number (VIN), and date vehicle was placed in service. If you received an advance payment of the credit at the point-of-sale (dealer), you are REQUIRED to reconcile that advance tax credit on your income tax return. We will need a copy of the Seller's Report (Form 15400) showing the amount of credit that was transferred to the dealer. For more details about vehicle tax credits, click here

-

Residential Energy Credits – Solar and Certain Energy Efficient Home Improvements – Documentation showing the date placed in service, description of the item described below, paperwork showing that it meets the requirement for a federal tax credit, and the amounts of any rebates. You may be entitled to a tax credit up to 30% of the cost for installing solar electric, solar water heating, wind energy systems, geothermal heat pumps, fuel cell property, and battery storage technology. In addition, up to $3,200 in tax credits (subject to various limitations) are available for the following items:

-

Electric or natural gas heat pump water heaters, electric or natural gas heat pumps, and biomass stoves and biomass boilers

-

Central air conditioners

-

Exterior windows and skylights

-

Exterior doors

-

Insulation materials or systems (including air sealing material or systems that reduce heat loss or gain)

-

Electric systems improvements and replacements

-

Home energy audits

For more details on the qualifications for these energy credits, click here

-

-

Please provide us with any other information and/or documentation you think we may need to accurately prepare your income tax return(s)